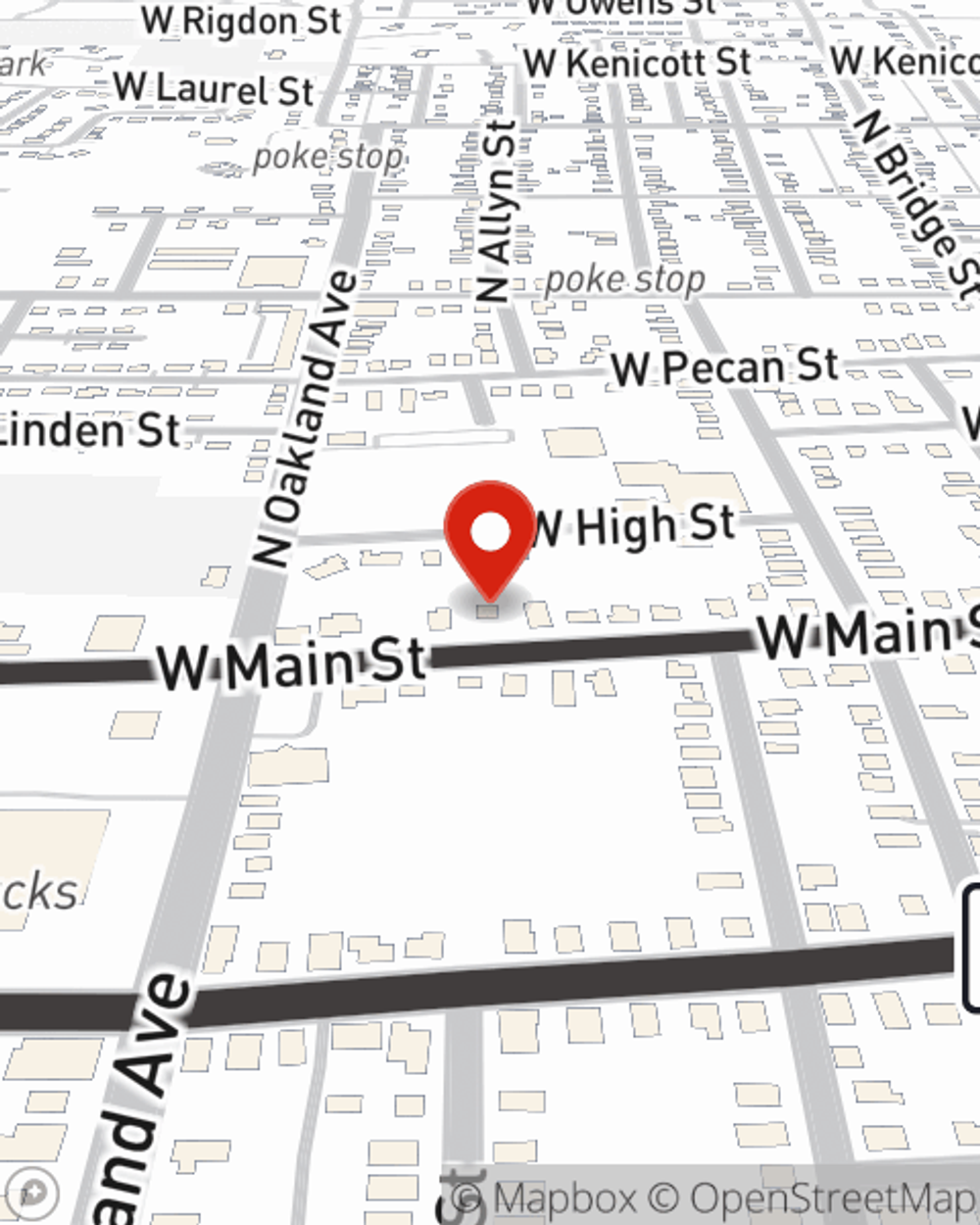

Condo Insurance in and around Carbondale

Carbondale! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Home Is Where Your Heart Is

When considering different coverage options, deductibles, and savings options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo but also your personal belongings within, including books, videogame systems, appliances, and more.

Carbondale! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Agent Navreet Kang, At Your Service

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Navreet Kang can be there whenever mishaps occur to help you submit your claim. State Farm is there for you.

That’s why your friends and neighbors in Carbondale turn to State Farm Agent Navreet Kang. Navreet Kang can explain your liabilities and help you select the smartest policy for you.

Have More Questions About Condo Unitowners Insurance?

Call Navreet at (618) 549-1755 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Navreet Kang

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.